US Foods Reports Third Quarter Fiscal Year 2024 Earnings

The financial statements of any business are greatly affected by the choice of inventory valuation method. The balance sheet, income statement, cash flow statement, and other key financial ratios reflect the choice and impact stakeholders’ decisions. As stated, one of the benefits of the LIFO reserve is to allow investors and analysts to compare companies that use different accounting methods, equally.

Trial Balance

This is advantageous in periods of rising prices because it reduces a company’s tax burden when it reports using the LIFO method. Nimble private companies have the ability to adjust their strategies quickly and can take advantage of the opportunities that exist in the current economic environment. Then, for internal purposes, such as in the case of investor reporting, the same company can use the FIFO method of inventory accounting, which reports lower costs and higher margins, which is attractive to investors. In periods of rising prices, constant increases in costs can create a credit balance in the 3 ways business owners can use rent as a tax deduction, which results in reduced inventory costs when reported on the balance sheet. These are non-GAAP financial measures, as defined below, and are used by management to allocate resources, assess performance against its peers and evaluate overall performance.

Implications for Financial Ratios and Cash Flow

In such a circumstance, a company that uses the LIFO method is said to experience a LIFO liquidation wherein some of the older units held in inventory are assumed to have been sold. It results in sale of old units that were purchased at potentially lower per unit cost. Identify which company uses LIFO method and calculate inventory turnover ratio for the companies for financial year 2014. The objective of using LIFO for external purposes is the inflationary economic conditions resulting in higher inventory costs.

Accounting Adjustments

- Then, for internal purposes, such as in the case of investor reporting, the same company can use the FIFO method of inventory accounting, which reports lower costs and higher margins, which is attractive to investors.

- Enhanced transparency allows shareholders to interpret performance trends appropriately accounting for inventory cost impacts.

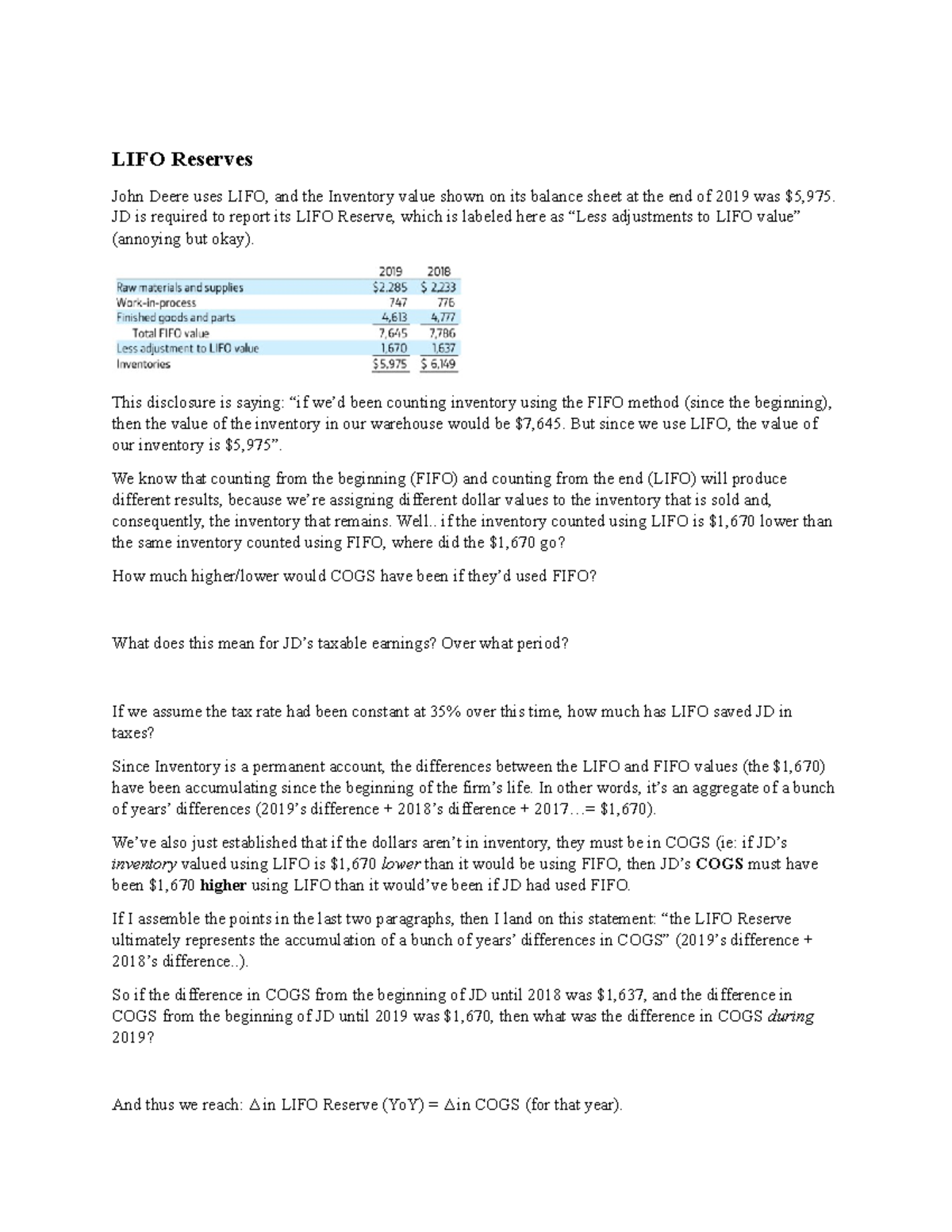

- The LIFO reserve may also increase over time as a result of the increasing difference between the older costs that are used to value inventory under LIFO and the more current costs that are used to value inventory under FIFO.

- Accounting professionals would agree that properly valuing inventory is critical for accurate financial reporting.

Accounting professionals would agree that properly valuing inventory is critical for accurate financial reporting. It is the difference between the reported inventory under the LIFO method and the FIFO method. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

Introduction to LIFO Reserve and Its Role in Accounting

Guidance incorporates the Company’s long-term strategic initiatives, including all transformational programs and tuck-in acquisitions. All comparisons are for the fiscal year-to-date 2024 compared with the fiscal year-to-date 2023, unless otherwise noted. All comparisons are for the third quarter of 2024 compared with the third quarter of 2023, unless otherwise noted. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

In the First in First Out method, it is assumed that you sell the products you purchased earlier first before moving on to the next product. There is no difference between the LIFO and FIFO methods if the cost of goods remains constant. An instance of this is when a company uses the LIFO reserve to submit earnings to tax services when the cost of production is constantly rising but uses LIFO internally to calculate budgets and higher margins. The issue with taking inventory with this method is that if there is a gradual increase in the cost of goods, then more profit than it is being made is recorded. The change in the LIFO reserve balance each year also impacts cost of goods sold and net income.

The forward-looking statements contained in this press release speak only as of the date of this press release and are based on information and estimates available to us at this time. We undertake no obligation to update or revise any forward-looking statements, except as may be required by law. The LIFO reserve is an account used to bridge the gap between the FIFO and LIFO methods of inventory valuation. The reserve helps to outline the many differences between the two methods and shows how each method would affect the company’s COGS (Cost of Goods Sold) in different situations.

The companies must report the LIFO Reserve in their financial statements when they use multiple inventory methods for internal and external reporting. Companies can choose to cost their Inventory based on various cost flow methods (namely FIFO inventory, LIFO inventory, Weighted Average Cost, and Specific Identification Method). It directly impacts the various financial ratios that various stakeholders use in analyzing the performance of various companies. Adjusted EBITDA and adjusted EBITDA by segment are not measures of performance under GAAP and should not be considered as a substitute for net earnings, cash flows from operating activities and other income or cash flow statement data. The Company’s definitions of adjusted EBITDA and adjusted EBITDA by segment may not be identical to similarly titled measures reported by other companies. We use Adjusted Gross profit and Adjusted Operating expenses as supplemental measures to GAAP measures to focus on period-over-period changes in our business and believe this information is helpful to investors.