Variable Costs Explained: Definitions, Formulas and Examples

However, over a six-month horizon, the factory will be better able to change the amount of labor to fit the desired output, either by using overtime hours, laying off employees, or hiring new employees. Thus, much of their labor becomes a variable cost – though not the cost of the managers, whose salaries are paid regardless of output. This refers to any expenses that fluctuate relative to the number of units the company produces, such as direct materials, direct labor, commissions, or utility costs.

- Variable and fixed costs play into the degree of operating leverage a company has.

- Sales commissions, for example, are also considered variable because the size of a commission is tied to the volume of products sold by an employee.

- Fixed costs are expenses that remain the same regardless of production output.

- For example, the chair company gets an order for 30 chairs for a total selling price of $2,400.

Exercises and Examples for Variable Costs

The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. Not sure where to start or which accounting service fits your needs?

What Is the Formula for Total Variable Cost?

This might mean reducing idle time, optimizing the use of raw materials, or improving production workflows. Such complexities can sometimes obscure the true variable costs, leading to misinformed decisions. While super bowl 2021 commercials understanding variable costs is vital, it’s equally essential to be aware of their limitations. Implementing knowledge of variable costs can lead to improved decision-making and better business strategies.

How much are you saving for retirement each month?

Because Variable Costs are tied to production, they are usually thought of as a constant amount expensed per unit produced. However, it’s important to note that variable costs do not always rise or fall in a perfectly linear fashion. There might be instances where economies of scale come into play, affecting the proportionality of these costs. Your goal should be to reduce the cost of producing each item, while maintaining the same level of quality. And that can considerably offset any money you save by cutting costs.

Choosing Expense Structure

For instance, sudden spikes in raw material prices or unforeseen changes in labor costs can significantly impact the variable costs of a business, affecting profitability. Raw materials are the direct goods purchased that are eventually turned into a final product. If the athletic brand doesn’t make the shoes, it won’t incur the cost of leather, synthetic mesh, canvas, or other raw materials. In general, a company should spend roughly the same amount on raw materials for every unit produced assuming no major differences in manufacturing one unit versus another.

Understanding Income Statements vs Balance Sheets

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

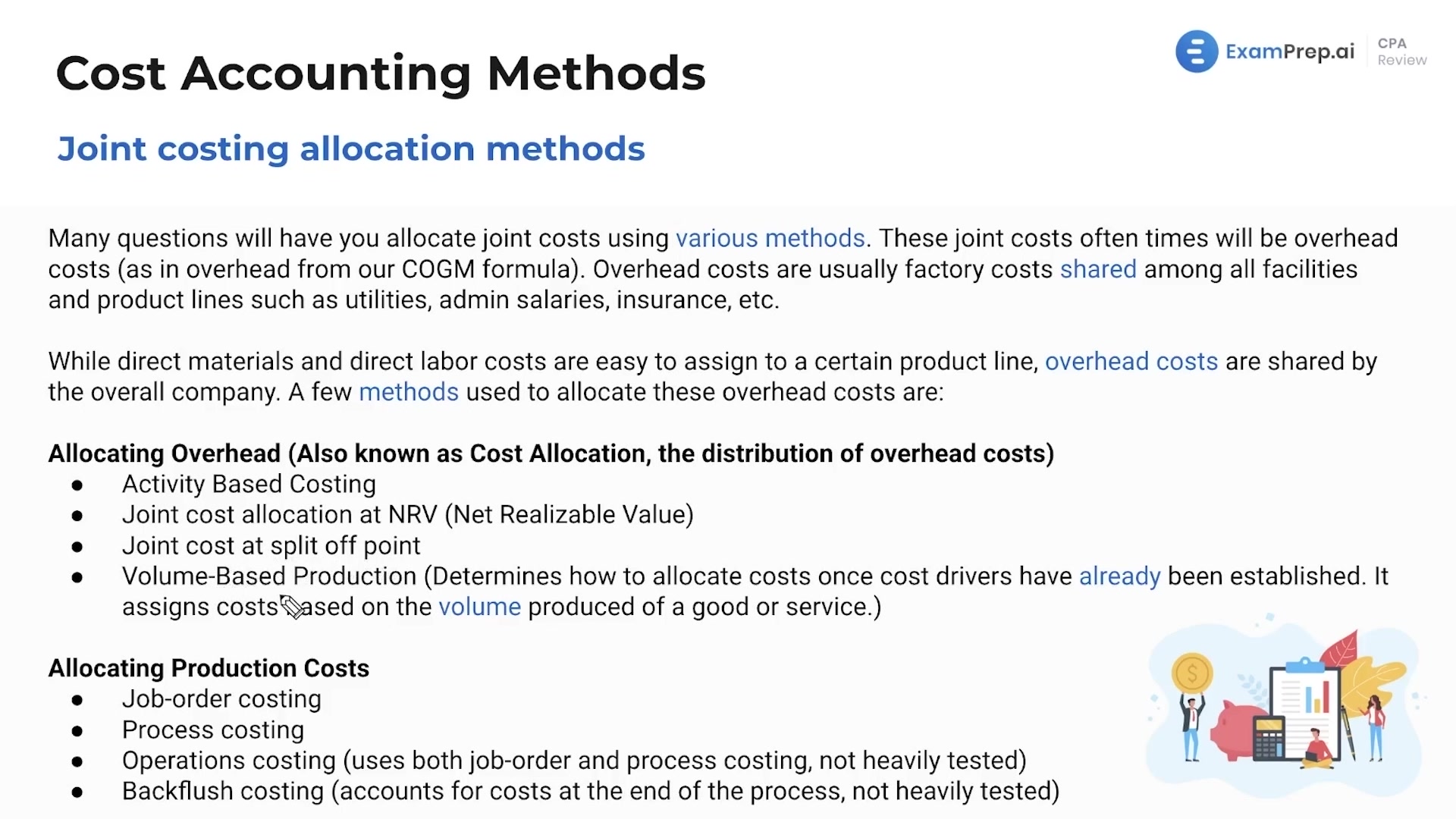

The difference between sales and total variable costs is the contribution margin, which is the amount available to pay all fixed costs. Under both methods, direct costs (materials and labor) and variable factory overhead costs are applied to the cost of the product. The difference between the two costing methods is how the fixed factory overhead costs are treated.

A company in such a case will need to evaluate why it cannot achieve economies of scale. In economies of scale, variable costs as a percentage of overall cost per unit decrease as the scale of production ramps up. Variable costs are directly related to the cost of production of goods or services, while fixed costs do not vary with the level of production.